Add your tax/business registration number to your invoice

To comply with regulations in your region/country, it may be required that your VAT, ABN or a specific type of tax/business registration number should be shown on all your invoices. With Invoice Falcon, our goal is to make sure your invoices are fully compliant and in this post, we’ll show you how to set that up!

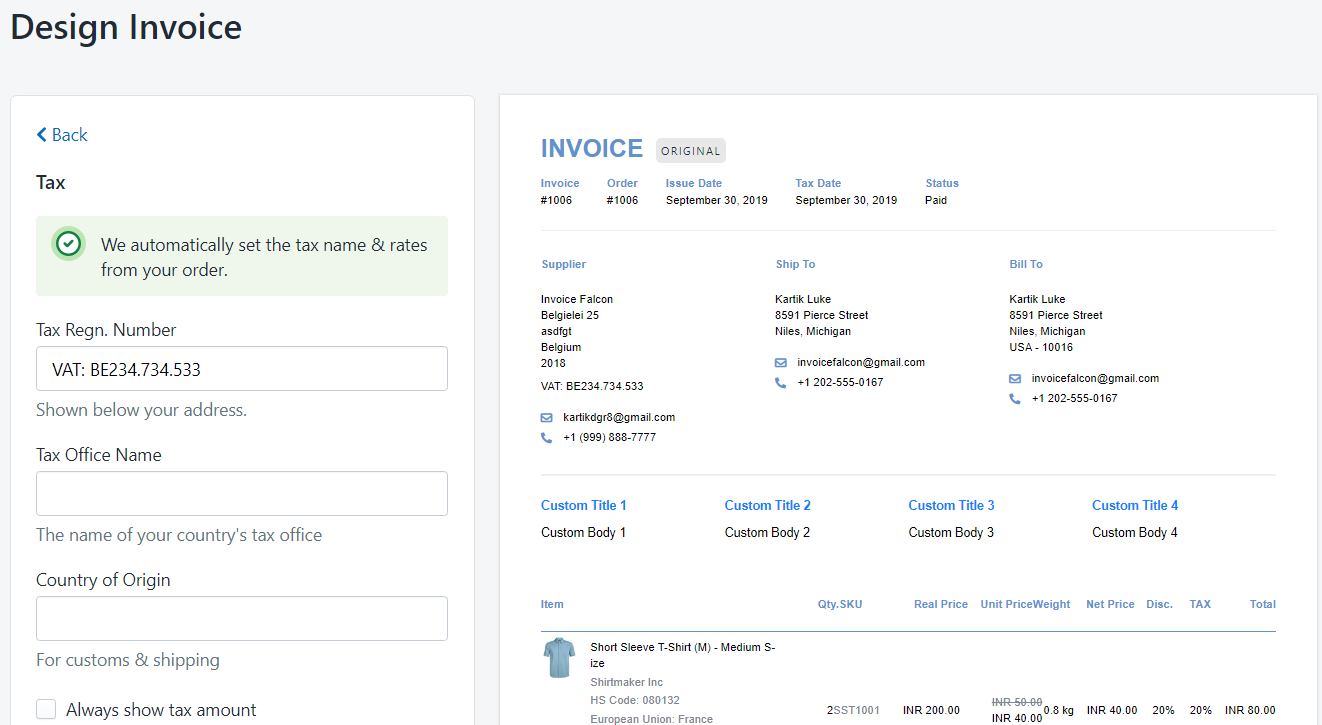

Click on Invoice Design in the left menu bar of our application & click on Tax & prices section in this page. You’ll see a few settings that look like this -

Tax Regn. Number

In the field labelled “Tax Regn. Number”, you can enter the specific registration number that you need to show in your invoice. The number you enter here will be shown underneath your address in the invoice.

For example, in the image above, the business’s ABN registration number is “XXXX123456” and so they’ve entered “ABN: XXXX123456” in the field.

Tax Office Name

In some countries, it may be required that you have to specify the department/office of taxation that your business is reporting to. If that is needed in your invoices, you can enter the name of the department in the ‘Tax Office Name’ field.

Make sure to click ‘Save Changes’ after you’re done! Your existing invoices will be automatically updated to include the changes you made here the next time it’s printed, sent or downloaded. :)